During the month of January, the company purchased and used 25,000 yards of soft fabric at $2.10 per yard, to produce 12,000 caps. … Most companies compute the materials price variance when raw materials are _____. multiple choice received from suppliers and transported to raw materials inventory. withdrawn from raw materials inventory and

Variance Analysis | PPT

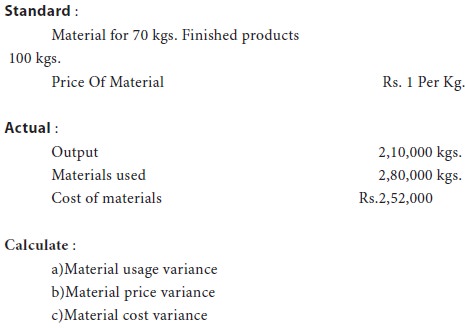

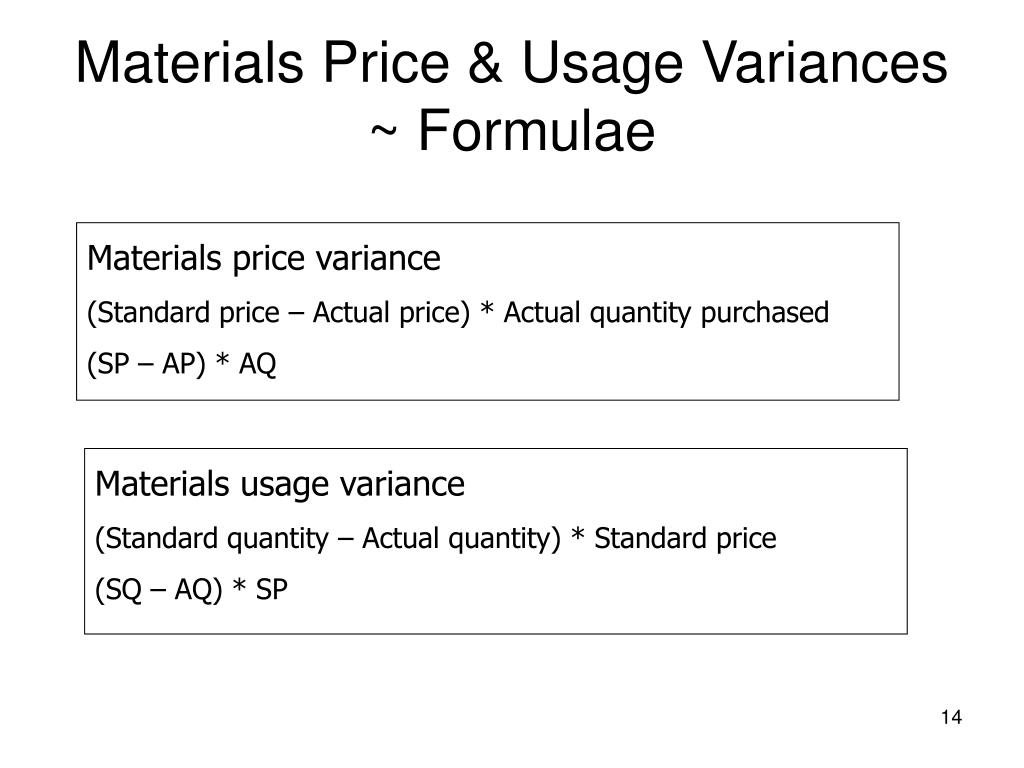

Mar 17, 2023This variance is calculated using the following formula: Price Variance = (Actual Price – Standard Price) x Actual Quantity. For example, if the standard cost of a material is $10 per unit, and you purchased 100 units of the material for $9 each, the price variance would be calculated as follows: Price Variance = ($9 – $10) x 100 = -$100.

Source Image: originals.com.sg

Download Image

Question: Most companies compute the materials price variance when raw materials are _______. multiple choice received from suppliers and transported to raw materials inventory. withdrawn from raw materials inventory and used in production. ordered from suppliers.

Source Image: arts.brainkart.com

Download Image

Direct Materials Price Variance | Double Entry Bookkeeping

A Material Price Variance Calculator is a tool commonly used in cost accounting and manufacturing to analyze the differences in the actual cost of materials used in production compared to the standard or expected cost. This variance helps businesses understand how material costs impact their profitability. The formula for calculating material

Source Image: originals.com.sg

Download Image

Most Companies Compute The Material Price Variance When Materials Are

A Material Price Variance Calculator is a tool commonly used in cost accounting and manufacturing to analyze the differences in the actual cost of materials used in production compared to the standard or expected cost. This variance helps businesses understand how material costs impact their profitability. The formula for calculating material

Let’s say our accounting records show that the company bought 6,800 board feet of lumber for that $38,080. The actual unit cost of raw materials then was $38,080 / 6,800 = $5.60. Let’s compute the direct materials cost variance: Actual cost per unit was $5.60. Standard cost was $6.00. Actual quantity of materials bought/used was 6,800 board

Nelly Armchair | Bespoke Fabric – Originals Furniture

Jun 24, 2022Material price variance = quantity of materials used x (budgeted price per unit of materials − actual price per unit of materials) Related: What Is Basic Accounting? 4 steps to calculate material price variance Here’s a process you can use to calculate material price variance: 1. Determine the quantity of product used

Nelly Fabric Armchair | Milk – Originals Furniture

Source Image: originals.com.sg

Download Image

Variance Analysis | PPT

Jun 24, 2022Material price variance = quantity of materials used x (budgeted price per unit of materials − actual price per unit of materials) Related: What Is Basic Accounting? 4 steps to calculate material price variance Here’s a process you can use to calculate material price variance: 1. Determine the quantity of product used

Source Image: slideshare.net

Download Image

Variance Analysis | PPT

During the month of January, the company purchased and used 25,000 yards of soft fabric at $2.10 per yard, to produce 12,000 caps. … Most companies compute the materials price variance when raw materials are _____. multiple choice received from suppliers and transported to raw materials inventory. withdrawn from raw materials inventory and

Source Image: slideshare.net

Download Image

Direct Materials Price Variance | Double Entry Bookkeeping

Question: Most companies compute the materials price variance when raw materials are _______. multiple choice received from suppliers and transported to raw materials inventory. withdrawn from raw materials inventory and used in production. ordered from suppliers.

Source Image: double-entry-bookkeeping.com

Download Image

Variance Analysis | PPT

May 2, 2023The prices that should have been paid to acquire this quantity of materials; Hence, the total material cost variance may result from the difference between the standard and actual quantities of materials used, the difference between the standard and actual prices paid for materials, or from a combination of the two. … Formulas to Calculate

Source Image: slideshare.net

Download Image

Materials Variances with Different Quantity Purchased and Used – YouTube

A Material Price Variance Calculator is a tool commonly used in cost accounting and manufacturing to analyze the differences in the actual cost of materials used in production compared to the standard or expected cost. This variance helps businesses understand how material costs impact their profitability. The formula for calculating material

Source Image: youtube.com

Download Image

PPT – VARIANCE ANALYSIS 1 PowerPoint Presentation, free download – ID:2740358

Let’s say our accounting records show that the company bought 6,800 board feet of lumber for that $38,080. The actual unit cost of raw materials then was $38,080 / 6,800 = $5.60. Let’s compute the direct materials cost variance: Actual cost per unit was $5.60. Standard cost was $6.00. Actual quantity of materials bought/used was 6,800 board

Source Image: slideserve.com

Download Image

Variance Analysis | PPT

PPT – VARIANCE ANALYSIS 1 PowerPoint Presentation, free download – ID:2740358

Mar 17, 2023This variance is calculated using the following formula: Price Variance = (Actual Price – Standard Price) x Actual Quantity. For example, if the standard cost of a material is $10 per unit, and you purchased 100 units of the material for $9 each, the price variance would be calculated as follows: Price Variance = ($9 – $10) x 100 = -$100.

Direct Materials Price Variance | Double Entry Bookkeeping Materials Variances with Different Quantity Purchased and Used – YouTube

May 2, 2023The prices that should have been paid to acquire this quantity of materials; Hence, the total material cost variance may result from the difference between the standard and actual quantities of materials used, the difference between the standard and actual prices paid for materials, or from a combination of the two. … Formulas to Calculate